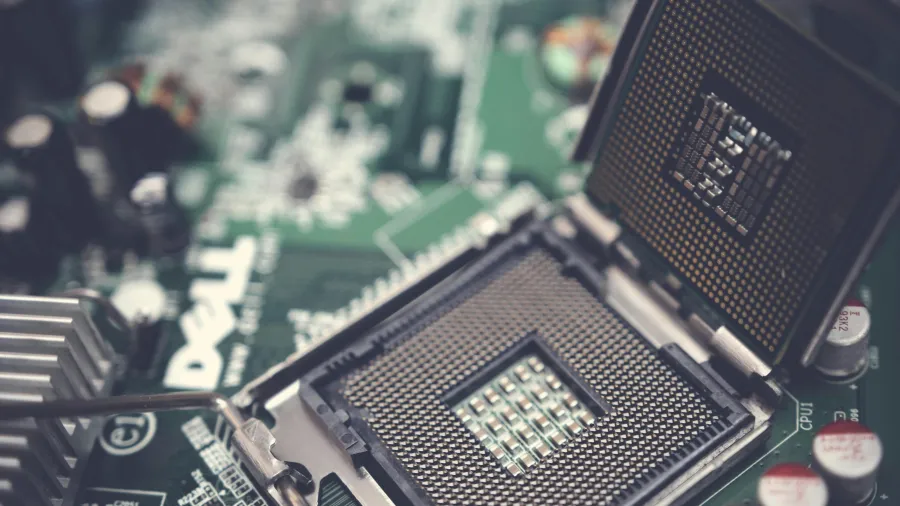

How semiconductor firms can stay resilient amidst geopolitical risks

PwC suggests starting with diversified manufacturing and sourcing.

The chip market is forecast to top US$1t by 2030 but tech companies may have to navigate an unpredictable geopolitical landscape, according to a PWC report.

PwC suggests starting with diversified manufacturing and sourcing. By diversifying their production sites and suppliers, companies can eliminate choke points and reduce the risk that will affect their operations.

Moreover, companies must develop an enhanced risk outlook by clearly identifying, assessing, and mitigating the risks to which semiconductor components are exposed.

Further, PWC said firms must respond nimbly to product-localisation pressures as government policies to fully or partially localise chip production present a special challenge.

Companies may be able to meet that challenge by adjusting their products only when necessary. Meanwhile, other companies will need to include regionally differentiated products or use drop-in replacements for individual semiconductors.

Lastly, firms must strengthen the talent pipeline. According to a recent study by Strategy&, PwC’s global strategy consultancy, Europe’s semiconductor sector alone will need around 350,000 more professionals by 2030.

In the EU and beyond, players in the industry will have to build significant talent resources to meet soaring local demand which will require a robust talent pipeline tailored to highly specific skills and competencies.