China's May PMIs raise concerns over recovery momentum: UOB

Weak data dampens confidence in economic recovery, heightening calls for government support.

China's economic recovery is facing hurdles as May's Purchasing Managers' Index (PMI) data appears discouraging. Both the official manufacturing and non-manufacturing numbers fell below expectations, indicating a slowdown and declining confidence in the economy.

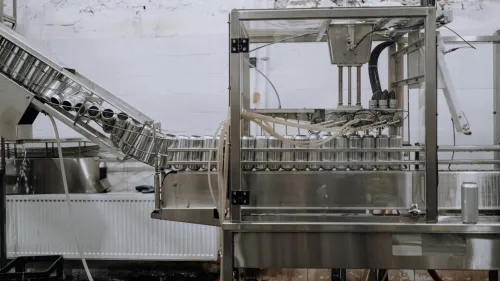

The manufacturing PMI released by the China Federation of Logistics & Purchasing (CFLP) remained in a state of contraction for the second consecutive month, recording a year-to-date low of 48.8 in May showing a decline of 0.4 points from the previous month. This marks the lowest reading this year and underscores the ongoing challenges that the manufacturing sector is grappling with.

The UOB Global Economics & Markets Research Report revealed that key indicators including production, new orders, new export orders, and employment all contracted as well, signifying the lack of stabilisation within the manufacturing sector and highlighting the pace of China's economic recovery momentum.

READ MORE: ASEAN manufacturing PMI slows in May on subdued demand

Despite the aforementioned challenges, the UOB Report expects China to maintain its growth forecast at 5.6% in 2023. Furthermore, the second quarter is expected to witness a substantial year-on-year increase of 7.8%, largely due to a favourable comparison with the low base during Shanghai's COVID-19 lockdown in the same period last year. This positive note is credited to factors such as improving domestic services demand, a stabilising property market, as well as the anticipated growth in global electronics demand.

UOB urges the government to reduce the banks' reserve requirement ratio to uphold adequate liquidity within the financial system. This step is vital for enhancing confidence and promoting stability in the labour market.

The government is expected to introduce specific incentives that can drive growth in high-end manufacturing. However, the likelihood of further interest rate cuts seems less probable, as the government may persist in adopting a measured approach and avoid excessive stimulus measures.