What went behind December's worsening PMI data?

The global manufacturing sector dropped to 49.6 in December.

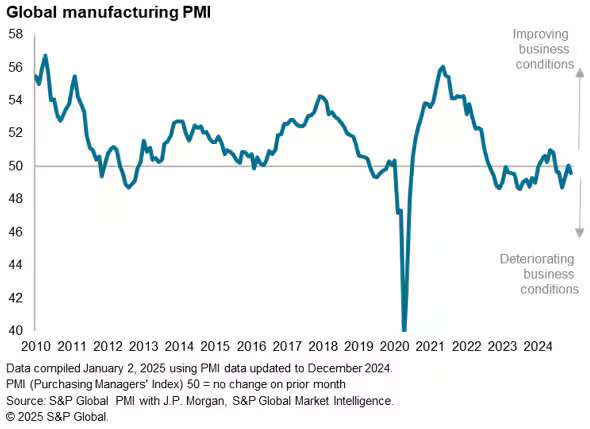

The global manufacturing sector returned to contraction in December after stabilising in November, dropping to 49.6 from 50, according to S&P Global Market Intelligence’s report.

Significant regional differences persisted, with the potential imposition of US tariffs in the coming year continuing to impact business conditions.

With this, the report noted five takeaways from December's manufacturing PMI survey sub-indices.

Europe and the US act as increasing drags on global production

The report noted that the PMI survey's sub-index of production, which tracks the monthly changes in factory output, fell back into contraction after slight marginal gains in October and November.

The decline was modest, indicating overall stagnation in output during the fourth quarter as a whole.

In total, output rose in just 12 of the 30 individual economies for which PMI data are available for December. Only six economies reported PMI output index readings of 53 or higher, a level above which noteworthy gains are signalled.

India reported the strongest expansion of production for the 19th successive month, and by a sustained wide margin, followed by the Philippines, Spain, Greece, Taiwan, and Canada.

This was offset by the wider eurozone production slump, which in December saw its sharpest decline in 14 months, marking the worst performance amongst major global regions, despite accelerating growth in Spain and Greece.

France, Germany, and Austria saw the three steepest production declines of the 30 economies surveyed, underscoring the sub-par performance of many eurozone member states, including the Franco-German core.

However, the eurozone has become less of an outlier in terms of its disappointing manufacturing performance, as accelerating and steep downturns were also recorded in both the US and the UK, where output fell in December at the fastest rates for 18 and 11 months, respectively.

Mainland China reports slower expansion

Mainland China saw continued output growth, whilst Japan's production remained nearly stable, and the rest of Asia reported solid gains, driven largely by India's strong performance.

However, Chinese producers experienced a notable downshifting in production growth compared to the uplift in November, further weighing on the global outlook.

The global goods trade picture worsens

The report noted that the worsening global production trend was driven by a sharp decline in global goods trade flows, as indicated by the PMI's New Export Orders index, which fell further into contraction territory in December, slipping to a three-month low.

In December, only a handful of economies reported higher export orders, with the eurozone notably underperforming. Producers in the US, the UK, and Japan also reported declining exports, but so did factories from Mainland China.

Whereas the latter had reported a resumption of trade in November, linked in part to the buying of goods from the US ahead of potential tariffs in 2025, December saw some payback from this advance purchasing.

US producers see an outsize jump in input price inflation

US producers reported a larger-than-average rise in input prices in December.

Amongst the 30 economies with December PMI data, only Australia saw a steeper jump in raw material cost inflation than US factories.

US firms consequently reported a steeper rate of increase than counterparts in Europe and mainland China.

Meanwhile, Japanese producers faced the highest cost increase amongst the world's major manufacturing economies, linked to higher import prices resulting from the weakened yen.

Global business optimism relapses

Aside from Russia, South Korea, and the Philippines, the biggest decline in business confidence was reported in the US. Whilst the pullback in US sentiment should be viewed in the context of November's notable post-election boost, the December survey reflected growing concerns about the potential for tariffs and immigration policies to cause further price hikes and supply chain disruptions.

However, confidence also declined in the UK, driven by concerns over new employment taxes, and across Asia due to tariff-related fears.

In contrast, the eurozone showed a rebound in confidence, albeit from a very low base; however, sentiment continues to be dented by political uncertainty and additional concerns over US-imposed tariffs.