Data centre capacity in Asia to rise up to 25% annually

Global investment in data centres and chip infrastructure hits $465b in 2024.

In South Asia and Southeast Asia, data centre capacity is expected to increase at a compound annual growth rate (CAGR) of 10% to 25% over the next few years, spurring investments and funding opportunities, according to ADB’s report.

Including committed builds, a substantial portion of the region’s pipeline supply as of the end of 2024 will come online within the next three to five years.

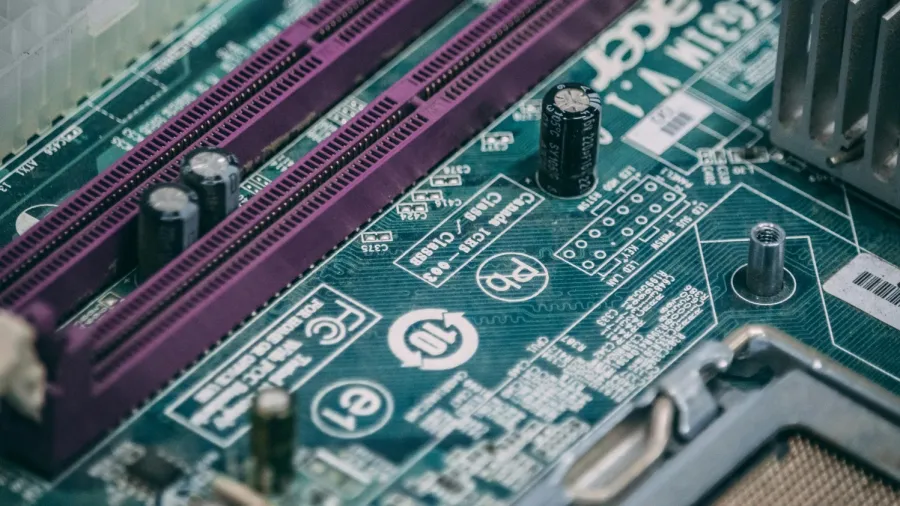

Asia’s strong position in semiconductor manufacturing is driving a rise in AI-related exports, with global investment in data centres and semiconductor infrastructure reaching an estimated $465b in 2024.

Semiconductor sales are expected to grow by 11% globally and 10% in Asia and the Pacific this year, based on forecasts from the World Semiconductor Trade Statistics group. This growth comes despite concerns related to artificial intelligence (AI) overinvestment.

Although training AI models is becoming more efficient and less resource-intensive, long-term projections suggest double-digit growth through 2030, fuelled by the spread of generative AI tools, broader enterprise use, increasing capital expenditure, and automation in manufacturing.

Beyond semiconductor exports, AI-powered industries such as robotics, software services, and cloud computing present new avenues for growth.

India’s IT industry has integrated AI solutions, contributing to $205b in software service exports in 2024. In China, AI-related automation is fuelling a surge in robotics manufacturing.