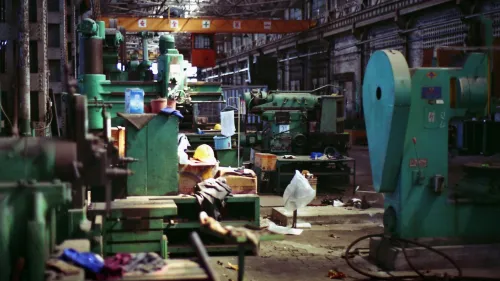

ESG practices critical for exporters entering new markets in SEA

Investors and partners want to see strong ESG credentials from firms entering the market.

Exporters and manufacturers expanding their business reach in Southeast Asia must be prepared to have strong environmental, social, and governance (ESG) practices as more customers, potential investors and partners want to see strong ESG credentials and practices.

Deloitte’s director of corporate finance and one of the judges for the Asian Export Awards, Jeremy Huang said that companies must focus on achieving sustainable growth and making a positive environmental and social impact in tandem.

Jeremy, who has over 10 years of M&A experience across industries such as manufacturing, industrials, mining & mining services and healthcare, explained that the manufacturing sector was and will continue to be a regional growth engine as it continues to in-source design and process IP.

In a brief conversation with Manufacturing Asia, Jeremy shared more of his insights on APAC’s export industry, the digitalisation of the industry and how he judged this year’s Asian Export Awards.

Which particular markets or sectors are your main focus? Can you share with us your work experience or any backstory that has contributed to your professional career?

I primarily cover the Contract Manufacturing and Electronic Manufacturing Services (EMS) sectors and advise on M&A and other corporate actions. In Southeast Asia, Deloitte’s Corporate Finance Advisory practice focuses on the mid-market. As such, we are honoured to count many entrepreneurs as our clients. They started their businesses in the 80’s and 90’s when the world looked to Southeast Asia as its new manufacturing engine. Their business is their life’s work, and they look to us to help them find investors or acquirers.

The manufacturing sector is a B2B industry and typically not well understood unless you are part of the supply chain. However, it was and still is an important driver of Southeast Asia’s growth story. For me personally, it is most rewarding to assist entrepreneurs and to understand the behind-the-scenes manufacturing supply chains responsible for delivering everyday consumers amazing products and technologies

What are the current trends that are shaping Asia Pacific's export industry?

For exporters in the Contract Manufacturing and EMS sectors, historically the key selling point has always been “value”. Design and process IP were typically held by brand owners and tier 1 / 2 OEMs who are usually located outside of Southeast Asia. As such, the main operating model for local exporters was that of an Original Equipment Manufacturer.

Increasingly, the model is changing - our local manufacturer/exporters being a Joint Development Manufacturer or an Original Design Manufacturer. Process IP and its associated capabilities such as front-end engineering and design, design for manufacturing and quality management is now front and center for local manufacturers. Whilst design is primarily still the domain of overseas brand owners, increasingly we will see our local companies export their own products and capture a larger part of the value chain. Singapore’s already vibrant start-up scene will only accelerate this process.

With markets recovering from the crisis, where are the opportunities now for exporters and manufacturers?

Initially, manufacturers were expected to perform poorly during the crisis. Whilst this was true in the beginning, it was short and temporary as the sector learnt to continue to operate and protect manufacturing staff. Certain end-markets such as automotive and some industrial products were also expected to endure a period of lower activity. However, global demand does not just stop and whilst some automotive manufacturing lines ran at lower capacity, manufacturing lines for other sectors such as consumer IT and communication products were operating at full capacity. The growth in this sector was already a secular trend, and the pandemic will only further accelerate the need for connectivity. Another benefactor is the IOT space, which allows data collection and automation without physical human intervention. These three end-markets present interesting opportunities for our local manufacturers and exporters.

What strategies and innovations can exporters leverage in order to expand their business reach? How can companies expand or develop new export markets?

Key would be how businesses in Southeast Asia broadly institutionalise knowledge and processes. This includes not only design and process IP but other internal processes such as sales. Many entrepreneurs have high conviction and excellent intuition. This is equally true for leaders in larger family conglomerates. However, as their businesses scale and they ready the next generation of leaders, leveraging existing knowledge and sales acumen across a larger base of developing talent will support and help local manufacturers and exporters target and succeed in new markets.

Having strong Environmental, Social, and Governance (ESG) practices layered into the manufacturing process is also critical in entering new markets. At Deloitte, we see a trend that customers, potential investors and partners want to see strong ESG credentials and practices in Southeast Asia. The focus is on achieving sustainable growth and making a positive environmental and social impact in tandem.

As businesses digitise, how can exporters and manufacturers be on board the digital trade era? What should they do to mitigate the risks that come with transformation?

In this equation, there are more opportunities than risks. We have seen the Industry 4.0 transformation globally but there is a slower uptake in Southeast Asia. IOT does not only represent a customer end-market for manufacturers, but also an enabler for our local manufacturers and exporters. Layered in with institutional knowledge, systems and processes, the usage of IOT can ensure ease of stock-keeping unit cataloguing, automated inventorying and pull-based manufacturing to increase both manufacturing efficiency and sales velocity.

As a judge in the Asian Export Awards, what key criteria have you considered in selecting the winners?

Innovation and value add makes up the baseline. Beyond that, the differentiator for me is really the ESG impact.